Alpha

Alpha, often considered the active return on an investment, gauges the performance of an investment against a market index used as a benchmark, since they are often considered to represent the market’s movement as a whole.

The abnormal rate of return on a security or portfolio in excess of what would be predicted by an equilibrium model like the capital asset pricing model (CAPM).

Beta

the beta (β or beta coefficient) of an investment indicates whether the investment is more or less volatile than the market. In general, a beta less than 1 indicates that the investment is less volatile than the market, while a beta more than 1 indicates that the investment is more volatile than the market. Volatility is measured as the fluctuation of the price around the mean: the standard deviation.

Beta is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors.

Beta is important because it measures the risk of an investment that cannot be reduced by diversification

Gamma and Treynor Mazuy Measure

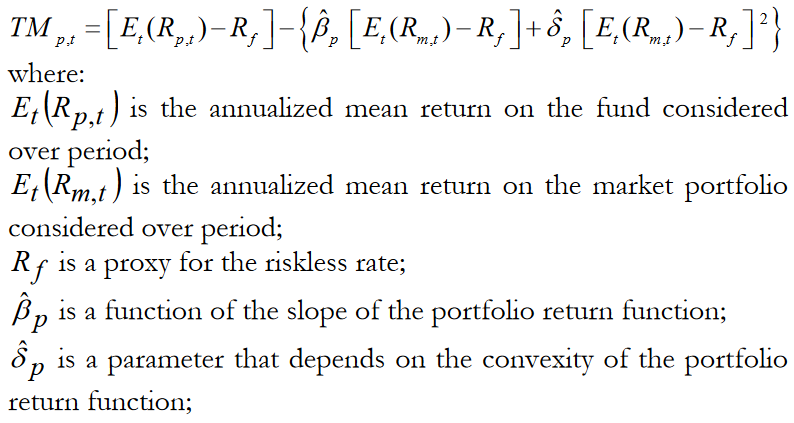

The Treynor-Mazuy Measure is an absolute measure of performance. It is given by the annualized return of the fund, deducted the yield of an investment without risk, minus the sum of returns on the two arbitrage portfolios multiplied by the estimated fund’s sensitivities to risk factors during the same period. The Treynor-Mazuy Measure gives the excess return obtained by the manager which is not explained by his/her current risk positions . The magnitude of the Treynor-Mazuy Measure depends on two variables: the return of the fund and risk sensitivities variability. This indicator represents the part of the mean return of the fund that cannot be explained by common factorial risk exposure .

Allows to estimate Treynor-Mazuy or Merton-Henriksson market timing model. The Treynor-Mazuy model is essentially a quadratic extension of the basic CAPM. It is estimated using a multiple regression. The second term in the regression is the value of excess return squared. If the gamma coefficient in the regression is positive, then the estimated equation describes a convex upward-sloping regression “line”. The quadratic regression is:

Rp – Rf = alpha + beta(Rb -Rf) + gamma(Rb – Rf)^2 + epsilonp

Gamma is a measure of the curvature of the regression line. If gamma is positive, this would indicate that the manager’s investment strategy demonstrates market timing ability. [i]

[i] Treynor J. and K. Mazuy, (1966), “ Can Mutual Funds Outguess the Market? ”, Haward Business Review 44, July-August 1966, pp.131-136