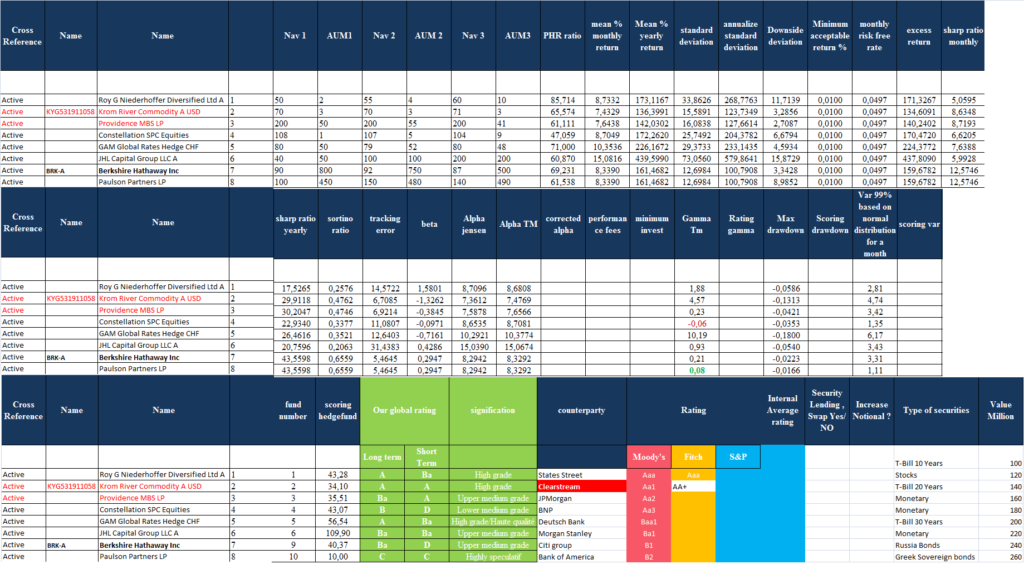

Alpha and Market risk

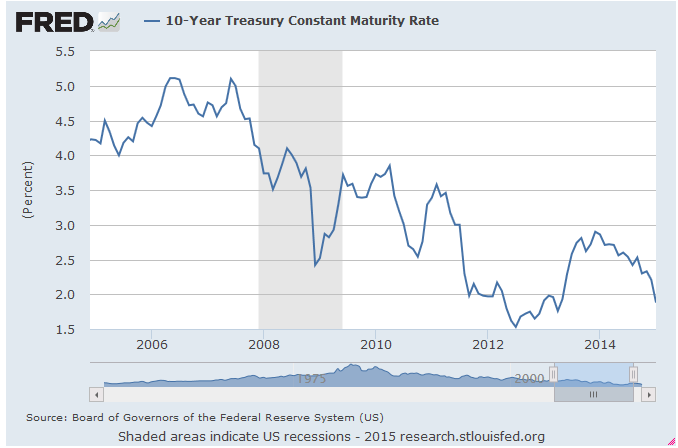

The financial system is based on debt. US Treasuries, the benchmark for an allegedly “risk free” rate of return, is the asset against which all other assets are priced based on their relative riskiness.

This “risk free” rate has been falling steadily for over 25 years.

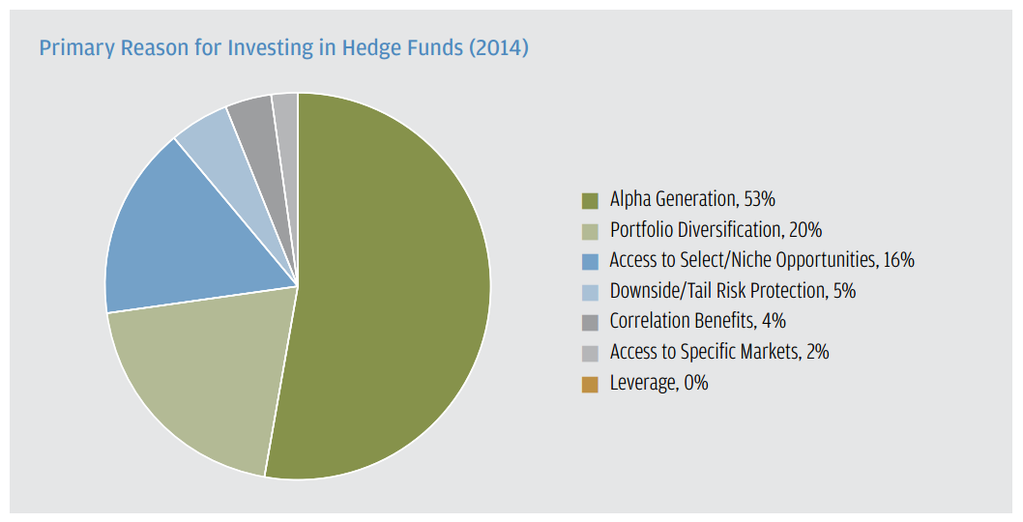

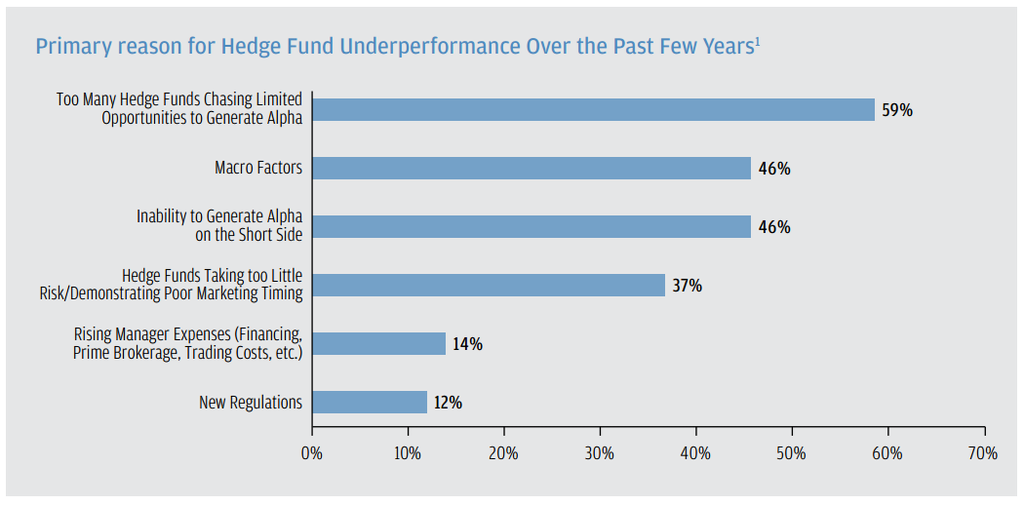

Unfortunately, with this level of return , Investor are seeking Alpha in Alternative investment fund and Hedge funds …

But some investors are not enough focus on risk and forgot to be focused on Gamma market timer

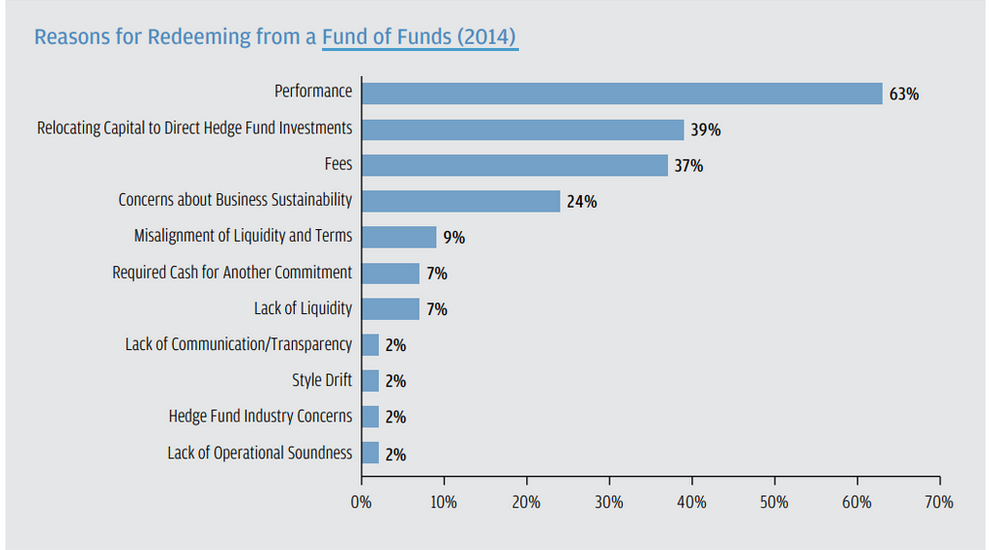

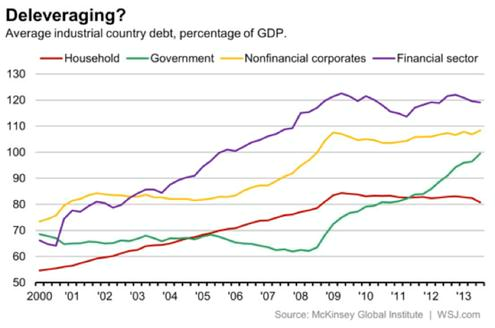

In the simplest of terms, the 2008 collapse occurred because of too much leverage fueled by cheap debt. This worked fine until the assets backstopping the leveraged trades fell in value, which brought about margin calls and a selling panic.

As McKinsey recently noted, there has been no meaningful deleveraging in any sector of the global economy (the best we’ve got is households and financial firms which have basically flat-lined since 2008).

Market change, alpha vs risk are not enough and should change on Gamma market timing ability versus risk .

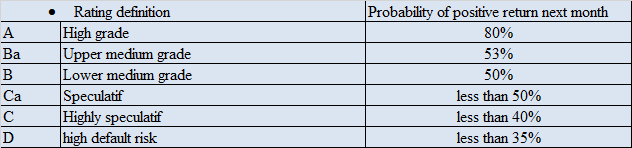

A Hedge funds rate AA by our company have 79.7% to have a positive return next month …

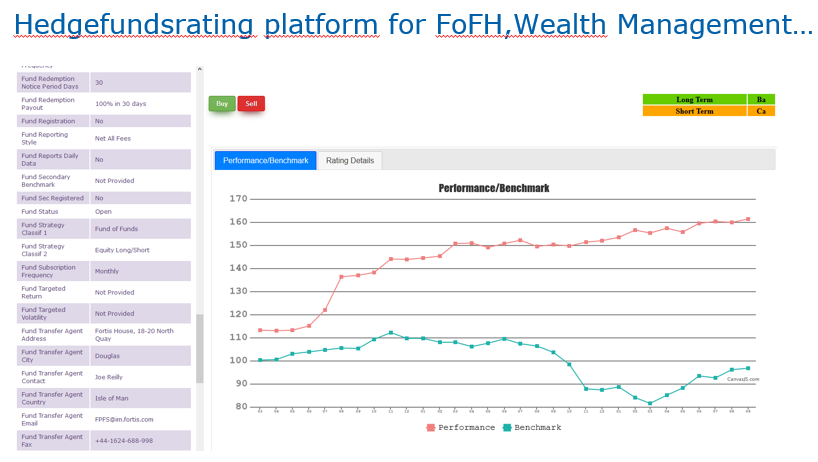

Hedge Funds Rating is the independent rating platform for hedge fund

investments and Management Compagny. Hedge Funds rating creates

actionable insights through a combination of non traditional financial and

regulatory data – all to deliver superior manager and market insights and

to help users make smarter and more informed investment decisions.

Hedge Funds Rating is the only product able to give you a rating of

Hedge Funds and their Custodian bank based on :

– The ability of the manager to be a constant market timer Versus the

risk used to create a return.

– The leverage of all Hedge funds to adjust the Custodian Bank rating

from Moody’s

Benefits

• Access: market insights and intelligence on the entire hedge fund

landscape. Triangulation of disparate, unstructured data reveals

unique intelligence.

• Allows: fund buyers to optimise Hedge fund selection in an open

architecture environment with access to more than 15,000 Hedge

Funds

• Management company Monitor: the risk of Counterparty / Challenge

decision of Fund of Hedge Funds manager

• Trading :Facilitate the investment of Institutional and Private banking

on Hedge Funds

• Increase the visibility of Hedge Fund and Alternative Investment Fund