Since hedge funds are not required to report their returns, most of the hedge fund returns are reported to data collectors on a voluntary basis and some data is rarely, if ever, disclosed (management fees…).

The increasing demand for hedge funds or recently AIFM funds, together with potential failures due to market risk impose a necessary operational due diligence process for selecting high quality managers and sufficiently liquid custodian banks, as commonly practiced by many prudent investors before placing their investments or before become the counterparty of a Custodian bank (c.f. Bears Stearns case, Credit suisse).

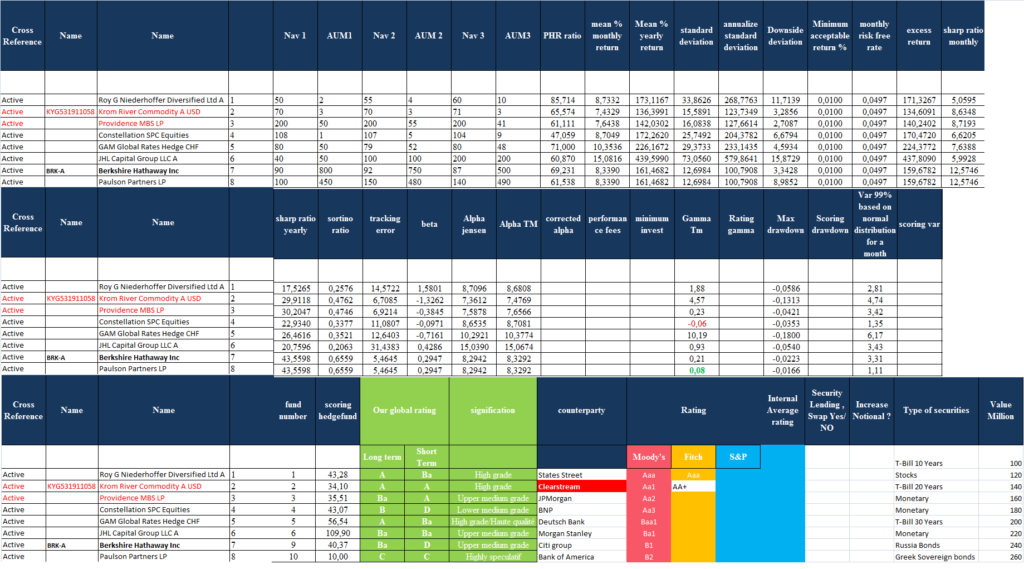

Due diligence is intensively conducted in the hedge fund industry; however, the current practice is mostly focused on the qualitative aspects instead of the quantitative aspects.The results of this paper will focus on quantitative aspects of hedge fund performance and correlation between key ratios. We will demonstrate that the risk/return concept can be replaced by a risk/market timing ability metric.

–Var (value at risk) is not enough to manage market risk . This rating complements a simple var approach

–Pro hedge Rating allows to manage market risk and credit risk between Custodian banks and Clients ( hedge funds, Mutual funds…) Should I lend to this fund?–Better management of collateral between counterparties and identify which Custodians have a heavy exposition in Hedge Funds ( securiies lending, …)

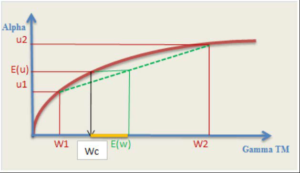

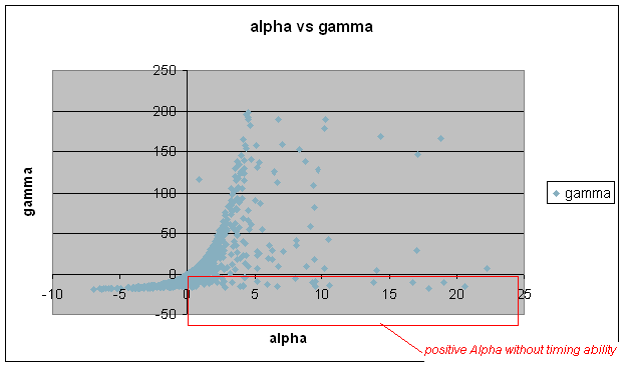

We developed a quantitative model called the Ɣ-Score to measure hedge funds’ market timing ability and risk of failure.

The Ɣ-Score can be used to measure the market timing ability of a fund manager. Combining statistical methodology and risk ratio analysis, I further extend the Ɣ-Score to enable forecasting of fund performance, probability of positive return, hedge fund failure and market risk for future months. Thus, I demonstrate that it is possible to forecast the probability of positive and negative returns in hedge funds using only monthly NAV. There is a significant and positive correlation between market timing ability, risk and hedge fund success or failure. Monthly NAV data permits us to identify all liabilities in funds, excess costs, the efficiency of the fund manager, as well as excessive risk taking behavior.

Using the Treynor and Mazuy Market Timing Model, the link between market timing, probability of return and risk make intuitive sense and appear highly correlated.

Since hedge funds are not required to report their returns, most of the hedge fund returns are reported to data collectors on a voluntary basis and some data is rarely, if ever, disclosed (management fees…).

The increasing demand for hedge funds or recently AIFM funds, together with potential failures due to market risk impose a necessary operational due diligence process for selecting high quality managers and sufficiently liquid custodian banks, as commonly practiced by many prudent investors before placing their investments or before become the counterparty of a Custodian bank (c.f. Bears Stearns case).

Due diligence is intensively conducted in the hedge fund industry; however, the current practice is mostly focused on the qualitative aspects instead of the quantitative aspects.The results of this paper will focus on quantitative aspects of hedge fund performance and correlation between key ratios. We will demonstrate that the risk/return concept can be replaced by a risk/market timing ability metric.

–Var is not enough to manage market risk . This rating complements a simple var approach

–Pro hedge Rating allows to manage market risk and credit risk between Custodian banks and Clients ( hedge funds, Mutual funds…) Should I lend to this fund?–Better management of collateral between counterparties and identify which Custodians have a heavy exposition in Hedge Funds ( securities lending, …)

For distributors and Hedge Funds Investors :

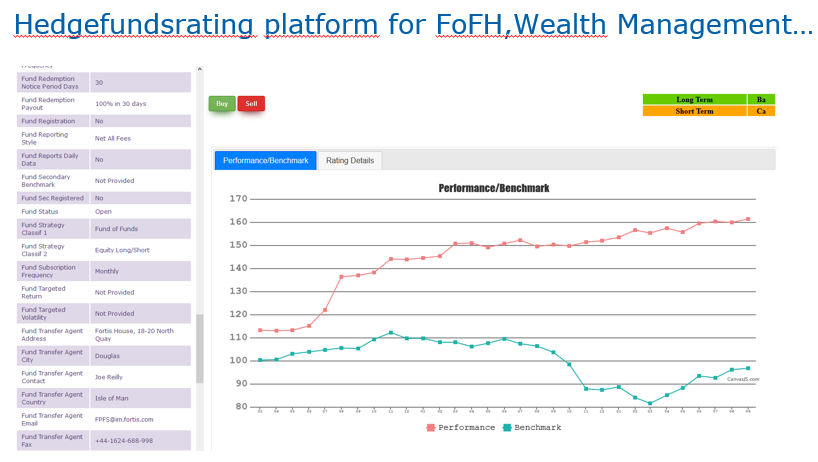

–We Purpose more than 15,000 Worldwilde Hedge Funds , SiF , Limited Partnership and Others Alternative Investment Funds ( AIF )

– Pro-Hedge Rating permits to challenge your model with our Robot Advisor

– Better seek Alpha with better risk management. Which Hedge funds give the best return without gambling

– Easy solution to rank Hedge Funds

How to separate best hedge funds from the rest ?

Currently Hedge funds Rating is the first Robot advisors which tell you which Hedge Fund is an efficient Market Timer and which one is less risky for your investment

Remember Higher is the Gamma higher is the probability of positive return

Usually , portfolio Manager use different analysis before invest in Hedge Funds , Quant Model ( Alpha, Skewness , Kurtosis…) but WHO challenge their decision ?

HSBC globally the same analysis with alpha and only 1 ratio “Maxdrawdown” . Each year, Bloomberg published a ranking based and return and only return ( without risk analysis, leverage…

Pro-Hedge Rating is not focusing on return, but only on the manager’s Market Timer and their risk management ability .

By a defined set of theories and equations this Pro-Hedge rating will recompute the benchmark and the porfolio[*] Pro Hedge rating is checking if the Fund Manager is able to buy low, sell high, short high and buy back low.